To revive a Massachusetts LLC, you’ll need to file all missing annual reports and the Application for Reinstatement Following Administrative Dissolution with the Massachusetts Secretary of the Commonwealth. You’ll also have to fix the issues that led to your Massachusetts LLC’s dissolution. Below, we provide a free, step-by-step guide to reinstating your Massachusetts LLC.

The Secretary of the Commonwealth of Massachusetts has the power to administratively dissolve your LLC if you fail to file annual reports for two years.

To get back into business, you’ll need to file all of your missing annual reports. Once you’re caught up on annual reports, you can apply for reinstatement. To revive or reinstate your Massachusetts LLC, you need to submit the following to the Secretary of the Commonwealth of Massachusetts:

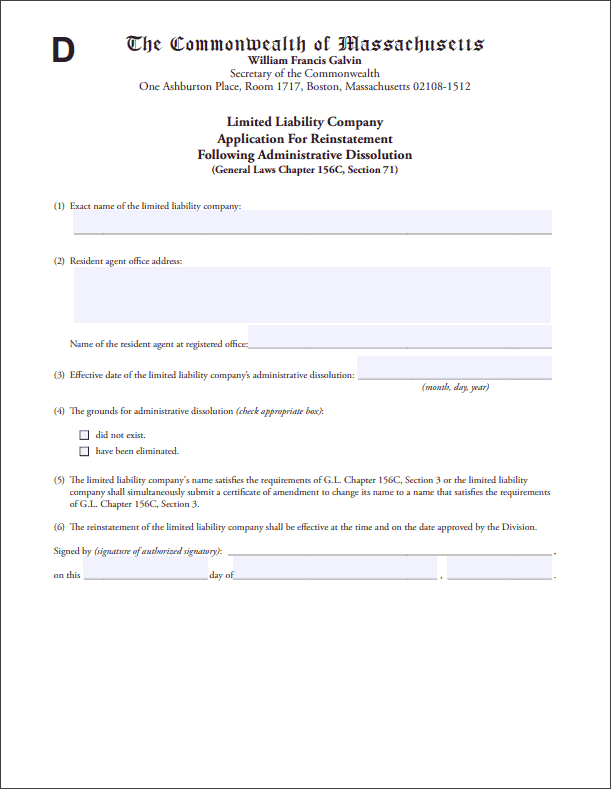

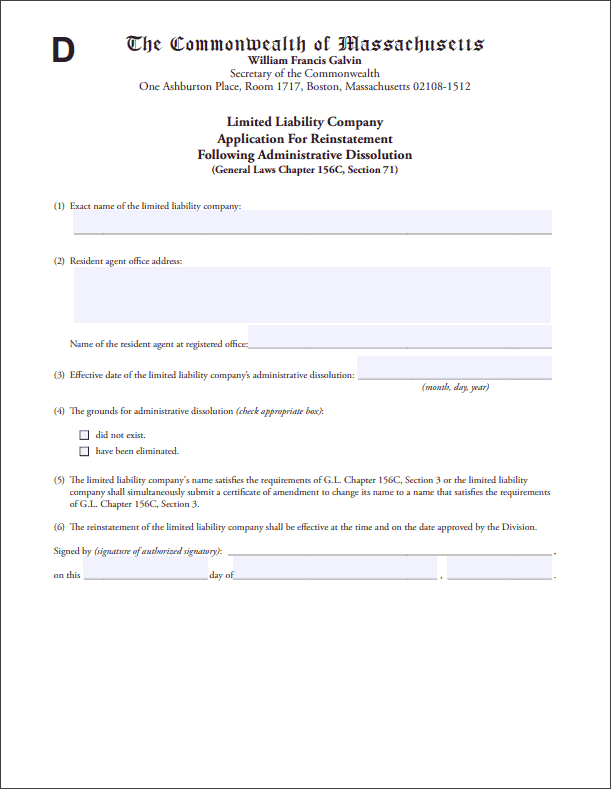

What information do I need for the Massachusetts Application for Reinstatement Following Administrative Dissolution?

To file the Massachusetts Application for Reinstatement Following Administrative Dissolution, you’ll need to provide:

You’ll need to check a box indicating that you’ve fixed the problems that led to dissolution or that the problems didn’t exist. There’s also a statement affirming that either your LLC’s name is still unique or you’re filing an amendment to change it.

The application should be signed by a member, manager, or someone you’ve authorized to do business on behalf of the LLC.

One year after the date of administrative dissolution, your Massachusetts LLC’s name becomes available for other businesses to use. If another company has adopted your LLC’s name, you’ll need to choose a new name and file a Massachusetts LLC amendment with your Application for Reinstatement.

You can file your Massachusetts Application for Reinstatement by mail, fax, online, or in person.

To fax your filing, you must use the Corporation Division’s form to create a tax voucher cover sheet. Using your own cover sheet may cause delays. You’ll need to generate a different fax voucher cover sheet for each filing.

Faxed and online filings cost an additional $10.

Payment options depend on how you plan to file:

The filing fee for an Application for Reinstatement Following Administrative Dissolution is $100. If you need to file an amendment to change your name, that will cost another $100.

Faxed and online filings are charged an additional $10.

The Massachusetts SOC processes the Application for Reinstatement in about 1-2 business days.

No. To change your Massachusetts registered agent, you’ll have to file the Massachusetts Statement of Change of Registered Agent.

You can revive a business in Massachusetts at any time.

Reinstatement applications are processed by the Massachusetts Secretary of the Commonwealth’s Corporations Division.

Mailed and In-Person Filings:

One Ashburton Place, Room 1717

Boston, MA 02108

Faxed Filings: