- Basic Introduction:

- Extension of AGM:

- Penal Provisions:

- Practical problems w.r.t AGM after due date:

- Compounding Law with RD or NCLT

Compounding of delay in Annual General Meeting

Basic Introduction:

The Companies Act, 2013 read with the Companies (Management and Administration) Rules, 2014 deals with the convening of Annual General Meeting.

It is mandatory to hold an Annual General Company to discuss the Annual results and other important discussions.

The company must give a clear 21 days notice to its members for calling the AGM.

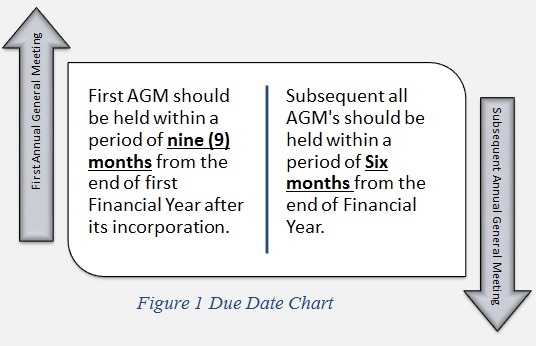

Due Date:

Extension of AGM:

Due to non-preparation of Financial Statements if any company desires an extension for AGM then the company can apply for an extension to ROC before the due date only.

ROC can give the extension maximum for 3 months only.

Special Note: Extension application cannot be done after expiration of due date of AGM for that relevant F.Y

Penal Provisions:

Companies have to comply with sections 96,97 & 98 for holding an AGM as per the law of the Companies Act 2013.

In case of contravention of the above sections, Companies have to bear the penalties and connected default fines.

Practical problems w.r.t AGM after due date:

i. Financial Statements signed after the due date of AGM?

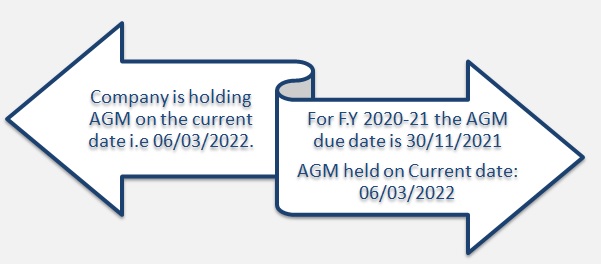

Let’s take an example for F.Y 2020-21.

Many Auditors have signed the Financials as of the current date due to the late preparation of Financial Statements.

In such a case, Companies need to hold the AGM on the Current date only.

So, there is a contravention of the above sections of AGM.

Penalty Provisions

- If any default is made in holding an AGM of the company in accordance with Section 96, 97, or section 98, the company and

- every officer of the company who is in default shall be punishable with a fine which may extend to one lakh rupees and

- in the case of continuing default, with a further fine which may extend to five thousand rupees for every day during which such default continues.

In our case of a company,

Now we are calculating the amount of penalty for holding AGM after due date.

Total period of delay is 96 Days

| Particulars | Mandatory Fine | Period of delay | Fine as per period of delay | Total Fine as on date |

| Company itself | Rs. 1,00,000/- | 96 | Rs. 4,80,000/- |

ii. Financial Statements signed backdated before the due date of AGM without UDIN?

Many Professionals sometimes ask for saving the penalties of the respective clients that can we sign the Backdated Financials.

As per ICAI UDIN law doing such kind of Practice is wrong and unlawful so kindly ignore such type of backdated signature of Financial Statements.

It’s better to do AGM on the current date and go for Compounding the matter with RD or NCLT.

Compounding Law with RD or NCLT

The Power of compounding is vested with Regional Director and National Company Law Tribunal.

It is totally depended on the amount of fine that who will initiate the application of compounding.

>If the Total fine is up to 25 Lakhs, then the compounding application deal is in the jurisdiction of the Regional Director.

>If the total fine exceeds 25 Lakhs, then the compounding application deal is in the jurisdiction of the National Company Law Tribunal.

In our case, the matter is in the jurisdiction of RD because the penalty amount is Rs. 17,40,000/-